Yes, Viagra (sildenafil) can be covered by an HSA, but it depends on several factors. Your HSA administrator’s specific formulary dictates which medications are eligible for reimbursement. Check your plan documents for details.

Generally, HSA plans cover prescription drugs, and if Viagra is prescribed for a medically necessary condition by your doctor, and the prescription is filled through an in-network pharmacy, reimbursement is likely. However, prior authorization may be needed. Contact your HSA provider directly to confirm coverage and any necessary pre-approval procedures.

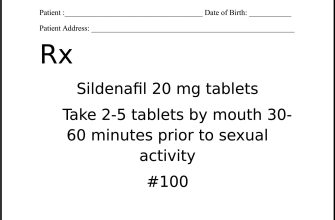

Remember, the cost of Viagra after HSA reimbursement will vary greatly based on your plan’s deductible, copay, and coinsurance. Carefully review your plan’s details to understand your out-of-pocket expenses. Generic sildenafil is often a more affordable option if your doctor approves.

In short: While HSA coverage is possible, proactively confirming coverage with your provider is crucial before incurring costs. This step avoids unexpected expenses and ensures a smoother claims process.

- Is Viagra Covered Under HSA?

- Prescription for Erectile Dysfunction Treatment

- Checking Your Plan Details

- HSA Plan Details Impact

- Generic Alternatives

- What is an HSA and How Does it Work?

- Viagra: Prescription Medication and Eligibility Requirements

- HSA Eligibility for Prescription Drugs: General Rules

- Specific Coverage of Erectile Dysfunction Medications Under HSAs

- Factors Affecting Coverage

- Steps to Determine Coverage

- Important Note:

- Factors Influencing Viagra Coverage: Plan Details and Pharmacy Networks

- Formulary Tiers and Copays

- Pharmacy Network Participation

- Prior Authorization Requirements

- Generic Alternatives

- Alternatives to Viagra and Their HSA Coverage

- Oral Medications

- Other Treatments

- Non-Medication Options

- Important Considerations

- Exploring HSA-Eligible Options for Erectile Dysfunction Treatment

Is Viagra Covered Under HSA?

Generally, Viagra is not covered by HSAs for recreational use. However, coverage depends heavily on your specific plan and the reason for prescription.

Prescription for Erectile Dysfunction Treatment

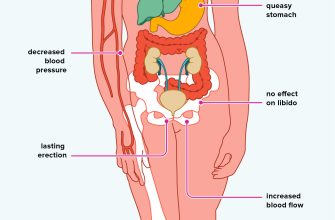

If your doctor prescribes Viagra to treat a diagnosed medical condition like erectile dysfunction, your HSA may cover it. This hinges on whether your health plan includes prescription drug coverage and how that coverage interacts with your HSA. Some plans explicitly exclude medications for erectile dysfunction unless linked to a diagnosed medical condition like pulmonary hypertension.

Checking Your Plan Details

The only definitive way to know is to examine your HSA plan documents carefully. Look for details on prescription drug coverage and any exclusions. Contact your HSA administrator or insurance provider directly if you have questions or cannot find the relevant information. They can offer the most accurate and up-to-date guidance.

HSA Plan Details Impact

Coverage can vary widely. Factors affecting coverage include:

| Factor | Impact on Viagra Coverage |

|---|---|

| Specific HSA Plan | Each plan has its own formulary (list of covered drugs) and rules. |

| Underlying Medical Condition | Treatment of a diagnosed condition is more likely to lead to coverage than recreational use. |

| Generic vs. Brand-Name | Generic alternatives, if available, might be covered while the brand-name may not. |

| Prior Authorization | Some plans may require pre-approval before covering certain medications. |

Generic Alternatives

Consider generic alternatives such as sildenafil, which may be covered under your plan where Viagra is not. Discuss these options with your physician.

What is an HSA and How Does it Work?

An HSA, or Health Savings Account, is a tax-advantaged savings account you can use to pay for eligible healthcare expenses. You contribute pre-tax dollars, lowering your taxable income immediately. Think of it like a retirement account, but for healthcare.

To open an HSA, you need a high-deductible health plan (HDHP). These plans have higher deductibles than traditional plans but lower monthly premiums. The IRS sets minimum deductible and out-of-pocket maximum requirements for HDHPs, so check their guidelines.

Contributions are limited annually. You can find the current contribution limits on the IRS website; they adjust yearly. Your employer might also contribute to your HSA.

You own your HSA funds. Unused funds roll over year to year, growing tax-free. You can withdraw funds tax-free for qualified medical expenses. Non-qualified withdrawals are subject to taxes and a 20% penalty (except in certain situations).

HSA funds can cover deductibles, co-pays, and other eligible medical expenses, such as prescriptions, vision care, and dental care (check your plan details). Consult your HSA provider for complete details on eligible expenses.

Many HSA providers offer debit cards for easy access to your funds. You can also pay directly from your HSA account with many providers. Manage your account online or through a mobile app for convenience.

Viagra: Prescription Medication and Eligibility Requirements

Viagra, or sildenafil, requires a prescription from a licensed healthcare provider. Your eligibility for coverage under a Health Savings Account (HSA) depends entirely on your specific HSA plan and your doctor’s prescription.

Check your HSA plan’s formulary. This document lists covered medications. Viagra’s inclusion varies significantly between plans. Some plans cover it; others don’t. Contact your HSA provider directly to confirm coverage. They can clarify specific requirements and cost-sharing details.

Your doctor’s diagnosis is critical. The HSA plan may only cover Viagra for specific conditions related to erectile dysfunction. Generic sildenafil may be covered even if brand-name Viagra isn’t. Ask your doctor about generic options; they often cost less.

Consider pre-authorization. Many HSA plans require pre-authorization before covering expensive medications like Viagra. This step ensures the prescription meets plan guidelines. Check with your provider for pre-authorization procedures and required documentation.

HSA plan limitations apply. Even with coverage, you’ll likely face co-pays or deductibles. Review your plan’s details to understand your out-of-pocket costs before using Viagra.

HSA Eligibility for Prescription Drugs: General Rules

To use your HSA funds for prescription drugs, they must meet specific requirements. Your prescription must be for a medically necessary drug, meaning a doctor prescribed it to treat a diagnosed medical condition.

High-deductible health plan (HDHP) requirement: Your HSA must be paired with a qualifying HDHP. These plans have higher deductibles and out-of-pocket maximums than traditional health plans. Check your plan documents for specifics.

Over-the-counter (OTC) medications: Generally, OTC medications aren’t covered by HSAs. However, some plans may offer exceptions; review your plan details carefully.

Prescription fulfillment: You typically need to obtain your prescription from a licensed pharmacy. Mail-order pharmacies are usually acceptable.

Reimbursement: You usually pay for the prescription upfront and then submit receipts for reimbursement from your HSA. Keep accurate records of your expenses.

Specific drug coverage: Your HSA administrator may have limitations on specific drugs. They might not cover certain medications or may require prior authorization.

Always consult your HSA plan documents for detailed information on coverage, reimbursement processes, and any restrictions on prescription drugs. Contact your HSA administrator if you have questions.

Specific Coverage of Erectile Dysfunction Medications Under HSAs

HSA coverage for erectile dysfunction (ED) medications depends entirely on your specific HSA plan and the pharmacy you use. There’s no universal answer.

Factors Affecting Coverage

- Plan specifics: Check your HSA plan’s formulary. This document lists covered medications and their cost-sharing details (copay, coinsurance). Some plans cover brand-name drugs; others prioritize generics.

- Generic vs. Brand-name: Generic versions of ED medications (like sildenafil) are usually cheaper and more likely to be covered than brand-name options (like Viagra).

- Pharmacy network: Using an in-network pharmacy often results in lower costs. Your plan’s formulary will list participating pharmacies.

- Prior authorization: Some plans require prior authorization for ED medications, meaning your doctor must obtain pre-approval before the drug is covered. This adds an extra step but can potentially save you money if successful.

Steps to Determine Coverage

- Review your HSA plan documents: Your plan’s official materials, including the formulary and summary plan description, detail coverage policies.

- Contact your HSA administrator: Call or email your HSA provider directly. They can confirm your plan’s specific coverage for ED medications and answer any questions.

- Check with your pharmacy: Your pharmacy can verify coverage based on your plan and medication choice. They can also provide cost estimates before filling the prescription.

- Consider alternatives: If your plan doesn’t cover your preferred medication, discuss alternative treatment options with your doctor. These might include different ED medications or other approaches.

Important Note:

This information is for guidance only and doesn’t substitute professional medical or financial advice. Always consult your healthcare provider and review your HSA plan documents carefully for the most accurate and up-to-date information.

Factors Influencing Viagra Coverage: Plan Details and Pharmacy Networks

Check your HSA plan’s formulary. This document lists covered medications, often categorizing them by tier, influencing your out-of-pocket costs. Viagra’s inclusion and tier placement directly impact your HSA reimbursement. Higher tiers usually mean higher costs.

Formulary Tiers and Copays

A higher tier for Viagra translates to a larger copay. For example, a Tier 3 drug might require a significantly higher copay than a Tier 1 drug. Therefore, understanding your plan’s formulary tiers is crucial for cost prediction. Always verify your copay before purchasing.

Pharmacy Network Participation

Using pharmacies within your HSA plan’s network is vital. Out-of-network pharmacies often charge substantially more, possibly exceeding your HSA’s coverage limit. Confirm your pharmacy’s participation in your plan’s network before filling your prescription.

Prior Authorization Requirements

Some plans require prior authorization for Viagra, necessitating a pre-approval process before dispensing. This procedure involves contacting your doctor and health insurer. Failing to obtain prior authorization might lead to denied claims.

Generic Alternatives

Exploring generic alternatives, such as sildenafil, can reduce costs. Generic versions often fall into lower formulary tiers, leading to lower copays and higher HSA reimbursement. Discuss generic options with your doctor.

Alternatives to Viagra and Their HSA Coverage

Many HSA plans cover alternative treatments for erectile dysfunction. Your specific coverage depends on your plan’s formulary and your provider’s billing practices. Always check with your insurance provider before beginning any treatment.

Oral Medications

- Cialis (Tadalafil): Often covered by HSA plans, but coverage varies. Check your plan’s formulary for details on cost-sharing. Generic tadalafil is usually cheaper.

- Levitra (Vardenafil): Similar to Cialis, coverage depends on your plan. Generic options can lower out-of-pocket expenses.

- Avanafil (Stendra): Coverage is less common than for Cialis or Levitra; confirm with your provider and insurer.

Other Treatments

Beyond oral medications, several other options exist, and some may be HSA-eligible depending on your plan.

Non-Medication Options

- Lifestyle Changes: Weight loss, regular exercise, and a balanced diet can significantly improve erectile function. These changes aren’t directly covered by HSA, but the resulting improved health may reduce the need for medication.

- Penile Implants: Surgical procedures are generally not covered unless medically necessary due to a specific condition. Pre-authorization is required. Confirm coverage with your insurance provider.

- Vacuum Erection Devices (VEDs): These devices are typically not covered by HSA plans, but their cost is often less than long-term medication.

- Counseling: Addressing underlying psychological factors contributing to erectile dysfunction may be covered by some HSA plans, particularly if related to a diagnosed mental health condition. Always verify with your insurer.

Important Considerations

Remember to obtain prior authorization for many treatments. Generic medications often have lower out-of-pocket costs. Compare pricing between different pharmacies, and always check your plan’s specific formulary for the most up-to-date coverage information.

Exploring HSA-Eligible Options for Erectile Dysfunction Treatment

Many HSA plans cover FDA-approved medications for erectile dysfunction when prescribed by a doctor. Check your specific plan’s formulary for details. Generic versions of medications like sildenafil (Viagra) are often more affordable and HSA-eligible. Consider exploring these options with your doctor.

Medication Costs: Prices vary widely based on dosage, pharmacy, and insurance coverage. Generic options significantly reduce out-of-pocket expenses, making them a more HSA-friendly choice. Always compare prices before filling your prescription.

Other HSA-eligible treatments: Beyond medication, some HSA plans cover certain types of counseling or therapy for ED, if deemed medically necessary by your physician. This is often a route for exploring underlying mental health factors contributing to the issue.

Before using your HSA: Confirm your plan’s coverage by calling your provider or checking the online formulary. Understand the allowed expenses, claims procedures and reimbursement timelines. Obtain all necessary prescriptions before incurring expenses.

Important Note: This information is for general knowledge only and doesn’t substitute professional medical advice. Consult your doctor to determine the best course of action for your individual situation.